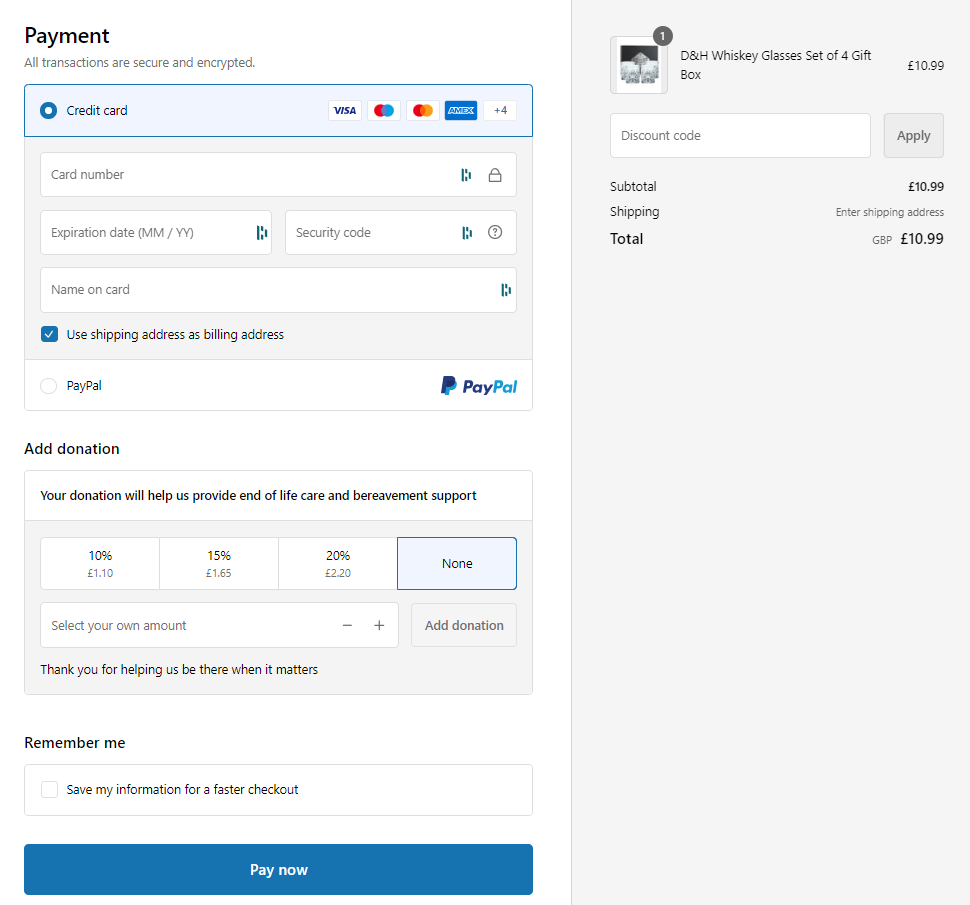

Square also integrates with over a hundred purposes for on-line sales. It also integrates with PayPal One-Touch, permitting donors to stay logged into PayPal and move rapidly by the checkout process. PayPal integrates with a range of ecommerce platforms similar to BigCommerce and WooCommerce that will help you arrange and handle your webpage. Both Square and PayPal are secure and easy to use as payment processors. Square has the power to create payment links and buttons so as to add to your website. PayPal provides the power to create payment hyperlinks and buttons to add to your web site with more customization features and integration options that allow you to just accept funds on a number of platforms. 10 cents. PayPal additionally does not cost any monthly fees, but while its rates are generally higher than Square’s, they can be fairly confusing, particularly for brand new merchants. We suggest Helcim with its zero monthly charges, interchange-plus pricing, automated quantity reductions, all-in-one hardware, and an choice to opt for ACH payments or move on bank card charges for larger savings. 10 cents per bill or 1% per invoice using the ACH fee method. To receive a payment, you possibly can request the consumer to make a switch to your account, use PayPal’s invoice service, or an invoice generator like Hiveage that helps paypal fee calculator australia to request a payment.

You possibly can compare quotes you get from merchant account providers and Paypal utilizing the calculator included in the article. Usually, you don’t must pay any fees if the particular person pays immediately from their PayPal funds or their linked checking account. For example, you may include a cryptocurrency choice on your PayPal checkout web page. calculate paypal goods and services fee checkout can be a well-liked cost option with online shoppers, making it an awesome addition to any webpage. However, the PayPal Zettle reader doesn’t have a card swipe choice when you get a whole three-in-one (swipe, dip, and faucet) fee setup for $49 with Square. In the case of PayPal vs Square invoicing, each programs assist you to create and send custom invoices, handle recurring funds, and ship reminders. Learn extra in our ultimate Square Invoice guide. Advanced invoicing options are also accessible for these wanting a extra custom-made look, plus further tools like multi-bundle estimates and milestone-based cost schedules.

You possibly can compare quotes you get from merchant account providers and Paypal utilizing the calculator included in the article. Usually, you don’t must pay any fees if the particular person pays immediately from their PayPal funds or their linked checking account. For example, you may include a cryptocurrency choice on your PayPal checkout web page. calculate paypal goods and services fee checkout can be a well-liked cost option with online shoppers, making it an awesome addition to any webpage. However, the PayPal Zettle reader doesn’t have a card swipe choice when you get a whole three-in-one (swipe, dip, and faucet) fee setup for $49 with Square. In the case of PayPal vs Square invoicing, each programs assist you to create and send custom invoices, handle recurring funds, and ship reminders. Learn extra in our ultimate Square Invoice guide. Advanced invoicing options are also accessible for these wanting a extra custom-made look, plus further tools like multi-bundle estimates and milestone-based cost schedules.

Additionally, you need to use automated cost reminders, advanced reporting, and recurring billing. Users can evaluate PayPal fees with these of other payment processors, guaranteeing the very best worth for his or her particular use case. However, PayPal chargeback charges vary from $15 to $20. Square additionally works properly for a variety of business types, including brick-and-mortar shops, restaurants, food trucks, fast-serve eating places, beauty salons, spas, gyms, farmers markets, or bazaars. What greatest describes your small business? Square vs PayPal: Price, Features & Which Is Best? Square took the top spots on our lists of the very best cell POS and main mobile bank card processors (although PayPal also positioned on these evaluations). Boosting on-line conversions: PayPal is recognized as some of the trusted safety seals within the funds business-on-line buyers may be extra prepared to make a purchase figuring out it’s backed and protected by PayPal. Square’s POS system and bank card processing make it the higher alternative for cell sales. For the reason that workflow of the academic establishments is heavily tied up with this system, a modification in the system can drive modifications within the workflow. Optimized so you can simply ring up sales on a smartphone or pill, the POS system does all the things on cellular that it does on desktop, together with reviews.

Should you loved this article and you wish to receive much more information about Paypal Fees Calculator Germany assure visit our own web-page.